what is considered income for child support in colorado

Other child support. Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan.

Voices For Utah Children A Comparative Look At Utah And Colorado Economic Opportunity School Readiness Utah Kids Education

Select Popular Legal Forms Packages of Any Category.

. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Child support is a court order requiring one spouse to pay the other for a childs basic expenses after a divorceMost divorces involving children end with one parent having to fulfill a child support order until the child turns 19 or older with some exceptions. A parents income is a key factor in deciding how much financial support is owed.

Colorado does use the income share method to calculate child support. The legislature recognizes that the. Be sure that you understand your rights and options when it comes to all aspects of your divorce.

Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. Colorado Child Support Guidelines For cases on or after. The court estimates that the cost of raising one child is 1000 a month.

Parties to a dissolution of marriage action with children or an allocation of parental responsibilities custody case will need to calculate a child support amount to be paid by the obligor consistent with Colorados statute. Unfortunately some parents try to lower the amount of child support owed. Your choice is how many of your childs expenses you believe are included in this amount.

Ad Instant Download and Complete your Child Support Forms Start Now. It is an equation set up so. Per the Colorado child support statute gross income includes rents ie.

The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child. July 1 2021. Income can refer to.

The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. You have three options. In the state of Colorado the amount of child support that a parent will receive in order to care for their child is a decision that is made based on the income of both parents as well as the general expenses of the child.

The non-custodial parents income is 666 of the parents total combined income. What is not included is said to be an extraordinary expense. 7031 Koll Center Pkwy Pleasanton CA 94566.

Contact the county child support caseworker handling your child support case. Posted in Child Support on August 25 2020. Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact.

An overview of how child support is determined in Colorado. By administrator Mar 2 2016 Blog. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent.

All Major Categories Covered. Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional. 1 - Basic Expenses.

The following may be factored into the formula. Affects child support is in the rare circumstance where a new spouse provides the parent money each month that could be considered income. In Colorado every child has the right to be financially supported by his or her parents whether the parents are married to one another or not.

Social security benefits including social security benefits actually received by a parent as a result of the disability of that. Therefore the non-custodial parent pays 666 per month in child support or 666 of the total child support obligation. Other customary expenses which the parents expressly include.

What Does Child Support Cover in Colorado. File a consumer dispute directly with the company who issued your credit report. 14-10-115 Colorado Child Support Guidelines has been updated three times in the last five years.

Colorados Schedule of Basic Child Support Obligations sets this amount. But surprisingly there is little judicial guidance as to how exactly rental income should be calculated for purposes of child support or alimony. What is Considered Income For Child Support in Colorado.

Income can refer to more than just the wages you earn at your place of employment however. For example if a new husband gives his wife a trust that pays her 10000 in. The Colorado Child Support Guidelines include a list of factors judges can consider when calculating a child support award.

Colorado courts use a unified mathematical formula. Contact the State Enforcement Unit of the CSS Program at 303 866-4323. This includes a 2018 change to how the courts define adjusted gross income and alimony or maintenance received.

What Constitutes Income for Child Support Purposes. Which moneys must be considered income from self -employment. Only Revised October 2021.

The guidelines use a formula based on what the parents would have spent on the child had they not separated.

Salaries In Over Half Of The U S Won T Pay The Bills

Sydney Martin Professional Lecture Activities Of Daily Living Fine Motor Skills And Sensory Stradegies For Children With Down Syndrome English Pdf Reinforcement Emotional Self Regulation

Aussie Lawyer Directory Aussie Lawyer Directory

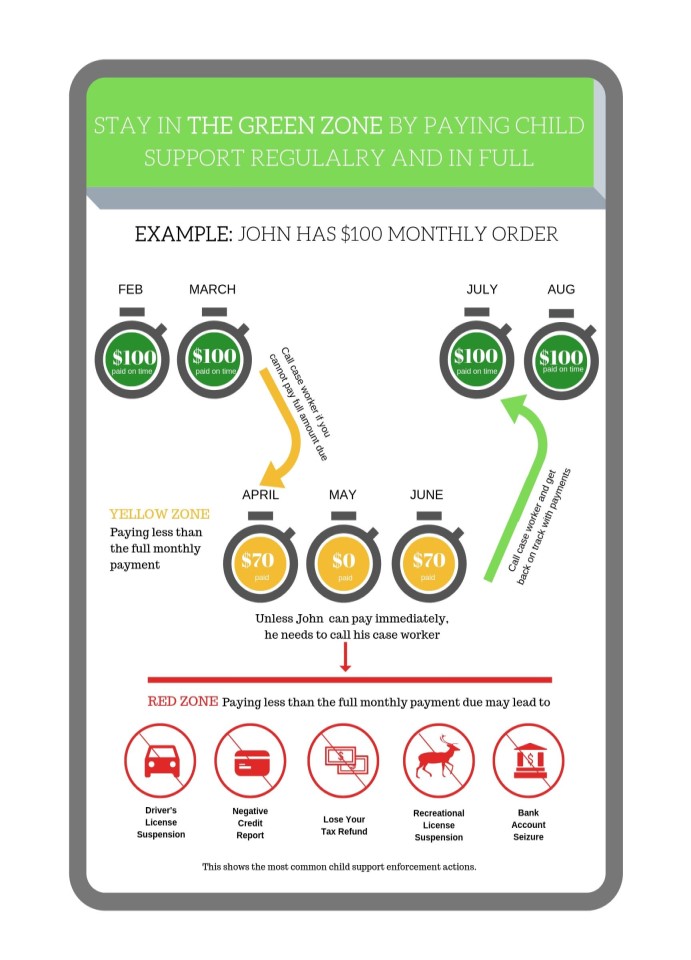

Enforcing Orders Colorado Child Support Services

Child Support Basic Obligation Colorado Family Law Guide

Emancipation For Colorado Child Support Colorado Family Law Guide

Child Support Modification Termination Colorado Family Law Guide

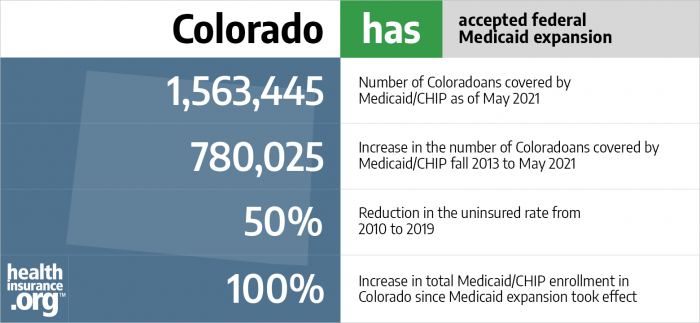

Aca Medicaid Expansion In Colorado Updated 2022 Guide Healthinsurance Org

New Vernon Washington Township Harding Long Valley Morris County New Jersey Divorce Child Support Mediator Child Support Laws Supportive Divorce And Kids

Sample Free Rental Application Form Template Forms 2022

Colorado Legal Research Colorado Legal Corporate Counsel

State Tax Levels In The United States Wikipedia

Financial Aid Appeal Letter Sample Templates At Allbusinesstemplates Com

Retirement Planner Spreadsheet Laobing Kaisuo